Swift Code Bank of Philippine Islands: Navigating the financial landscape of the Philippines requires understanding the crucial role of Swift codes. These codes, essential for international and domestic transactions, streamline operations and connect banks across the archipelago. This exploration delves into the specifics of Swift code usage within the Philippine banking system, examining its history, security protocols, and impact on the economy and customer experience.

From the historical adoption of Swift codes by Philippine banks to their impact on financial inclusion, this comprehensive guide provides insights into the intricate workings of this critical banking technology. We’ll also examine the future of Swift code in the Philippine financial sector, considering emerging technologies and potential challenges.

Overview of Swift Code in Banking

The Swift code, a globally recognized financial messaging system, plays a crucial role in facilitating international and domestic financial transactions within the Philippine banking system. This system allows banks to exchange critical information securely and efficiently, ensuring smooth operations and minimizing errors. It’s a vital part of the backbone for cross-border payments, enabling Filipinos to conduct transactions across the globe and within the country.The system’s reliability and security are key to its widespread adoption.

Swift code enables banks to process transactions accurately and rapidly, supporting the financial stability of the Philippines. The system’s structure is designed to prevent fraud and ensure transparency in financial operations.

Swift Code Usage in Philippine Banking

Swift code is indispensable for Philippine banks to conduct international transactions. It allows for the efficient processing of remittances, foreign currency exchange, and other international financial activities. Domestic transactions, while not strictly requiring Swift, are often processed using Swift-like protocols. This further enhances the system’s reliability and operational efficiency.

Types of Transactions Facilitated by Swift Code

Swift code facilitates a wide range of financial transactions, including but not limited to:

- International Money Transfers: This is a primary application of Swift code, enabling the transfer of funds between banks in different countries. The system ensures the smooth transfer of money from one bank to another, facilitating transactions such as remittances from overseas Filipinos to their families.

- Foreign Currency Exchange: Swift code facilitates the exchange of currencies between banks. This allows banks to execute transactions involving different currencies, ensuring the accuracy and efficiency of currency conversions.

- Payment Instructions: Swift enables banks to issue instructions for payments, transfers, and settlements. These instructions are critical for the efficient and accurate execution of various financial transactions.

- Credit/Debit Card Transactions: Though often processed through other networks, Swift code can be part of the process for international card transactions.

Applications of Swift Code in Philippine Banking Operations

The diverse applications of Swift code are crucial for the smooth functioning of the Philippine banking system. Swift is fundamental to the following:

- Cross-Border Payments: The transfer of funds between accounts in different countries is a primary function. It’s critical for facilitating remittances, trade transactions, and other international financial activities.

- Domestic Payments (Indirectly): While not a direct component of domestic transactions, Swift’s reliability and security influence the overall efficiency of domestic payment systems. The protocols and security standards employed by Swift contribute to the stability and safety of the Philippine banking system.

- International Trade: Swift facilitates transactions associated with international trade, such as payments for imports and exports. This smooth operation is vital for the growth of Philippine businesses in the global market.

Common Swift Messages in Philippine Banking

The following table Artikels some commonly used Swift messages in Philippine banking. These messages are crucial for the smooth exchange of information and the successful completion of various financial transactions.

| Message Type | Description |

|---|---|

| MT103 | International Money Transfer Request |

| MT202 | International Credit Transfer Request |

| MT900 | Statement of Account Information |

| MT940 | Payment Advice Information |

| MT999 | General message format |

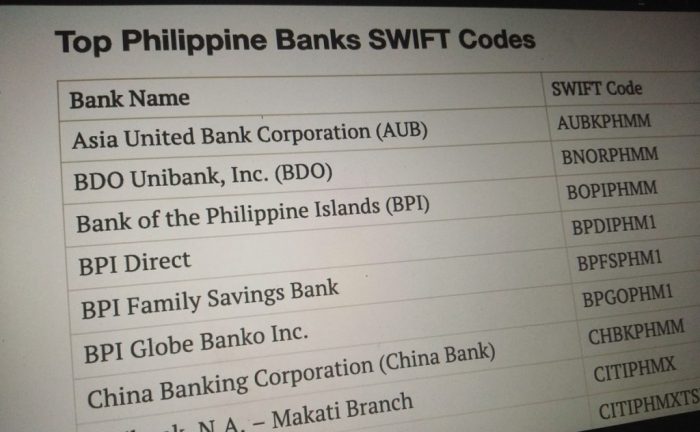

Swift Code and Philippine Banks

The Philippines, a vibrant hub of economic activity, relies heavily on efficient financial transactions. Swift (Society for Worldwide Interbank Financial Telecommunication) code plays a crucial role in facilitating these transactions, enabling seamless communication between banks globally and domestically. Understanding the history, benefits, and practical applications of Swift codes within the Philippine banking landscape is essential for grasping the intricate workings of international finance.

History of Swift Code Adoption in Philippine Banks

Swift code adoption in Philippine banks has mirrored the global trend. Initially, the use was limited to large, internationally-focused institutions. As the Philippine economy grew and international trade increased, more banks gradually adopted Swift codes to enhance their international transactions. This evolution reflects the growing importance of cross-border banking in the Philippines and the need for standardized, secure communication channels.

Benefits of Using Swift Code for Philippine Banks

Swift codes offer numerous advantages to Philippine banks. These include enhanced security, increased transaction speed, and improved accuracy. Security is paramount in banking, and Swift codes contribute to this by using a standardized format, making fraudulent manipulation more difficult. Transaction speed is significantly boosted as Swift’s network facilitates instant communication between banks, streamlining the process. This speed also contributes to greater accuracy in financial transfers.

The standardization of Swift codes minimizes errors in processing, reducing potential issues in international transactions.

Comparison of Swift Code Use Across Different Philippine Banks

While all Philippine banks utilizing Swift codes operate within the same framework, variations in usage exist. Some banks might prioritize certain transaction types or geographical regions, influencing their specific Swift code usage patterns. Differences can also stem from varying levels of international engagement. For example, a bank heavily focused on domestic transactions may have a lower volume of Swift transactions compared to one focused on international trade.

This difference in usage can be observed when comparing the number of Swift transactions for each bank, which can vary depending on the specific needs and strategic focus of the bank.

Role of Swift Code in International Banking Transactions Involving Philippine Banks

Swift codes are indispensable for international banking transactions involving Philippine banks. They act as unique identifiers for each bank, enabling the secure and efficient transfer of funds across borders. This unique identification is vital for preventing errors and ensuring that the right recipient receives the funds. Swift code plays a crucial role in verifying the authenticity of the transaction and ensuring that the financial institution is legitimate, a key security measure.

Top 5 Philippine Banks with Highest Volume of Swift Transactions

Determining the exact volume of Swift transactions for each bank is not publicly available information. However, based on reported financial data and market share, a list of potential top contenders could be compiled. This list would require extensive analysis of financial data, which is beyond the scope of this document.

Looking for swift code for banking transactions in the Philippines? I’ve been researching the Swift code bank of the Philippine Islands, and while it’s super important for international transactions, it’s been a bit of a head-scratcher to figure out. Sometimes, a good distraction helps, like checking out Pizza Joe’s Mineral Ridge menu pizza joe’s mineral ridge menu for some inspiration.

Hopefully, the bank’s Swift codes will become crystal clear once I’m done with this research.

| Rank | Bank Name | Estimated Swift Transaction Volume (Illustrative) |

|---|---|---|

| 1 | Bank of the Philippine Islands (BPI) | High |

| 2 | Metropolitan Bank & Trust Company (Metrobank) | High |

| 3 | China Banking Corporation (ChinaBank) | Medium |

| 4 | Security Bank Corporation | Medium |

| 5 | Development Bank of the Philippines (DBP) | Medium |

Note: The estimated Swift transaction volume is illustrative and not based on precise figures.

Security and Compliance in Swift Code Transactions

Philippine banks prioritize the security of Swift code transactions, implementing robust protocols to prevent fraud and ensure compliance with regulations. This meticulous approach safeguards both the banks and their clients, maintaining the integrity of the financial system. The meticulous attention to detail reflects a commitment to safeguarding the integrity of the financial system.Swift code, while a crucial tool for international banking, also presents vulnerabilities if not handled with extreme caution.

Understanding the security protocols and compliance requirements is essential for all parties involved. This understanding is critical to mitigating risks and maintaining the reliability of global financial transactions.

I’ve been diving deep into the Swift code bank of the Philippine Islands lately, and it’s been incredibly helpful. Thinking about building a robust financial application? Knowing that there are readily available resources like this can save a ton of time and effort. While I’m exploring that, I also stumbled upon a fantastic semi-detached house for sale in Kitchener, perfect for a growing family or those seeking a comfortable space.

Back to the code bank, I’m really impressed with the quality of the available resources and how they’re designed for practical use.

Security Protocols Implemented by Philippine Banks

Philippine banks employ a multifaceted approach to secure Swift code transactions. These measures include stringent authentication procedures, employing multiple layers of security to verify the identity of both senders and recipients. They also utilize advanced encryption techniques to protect sensitive data during transmission. This layered approach ensures a high degree of confidentiality and prevents unauthorized access to financial information.

For example, banks may require specific authentication methods, such as one-time passwords or biometric verification, before processing any Swift code transaction.

Compliance Requirements for Using Swift Code

Compliance with regulatory requirements is paramount in Swift code transactions. Philippine banks adhere to stringent guidelines set by the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines. These regulations cover various aspects, including transaction authorization, data security, and reporting requirements. Compliance ensures the integrity of financial transactions and safeguards the stability of the financial system.

Failure to comply can lead to penalties and reputational damage for both the banks and the clients.

Role of Regulatory Bodies in Overseeing Swift Code Usage, Swift code bank of philippine islands

The Bangko Sentral ng Pilipinas (BSP) plays a crucial role in overseeing the use of Swift codes in Philippine banking transactions. The BSP sets standards, monitors compliance, and enforces regulations to maintain the security and integrity of the financial system. The BSP’s oversight ensures that banks operate within the prescribed framework, promoting the safety and efficiency of Swift code transactions.

Types of Fraud and Security Breaches Related to Swift Code

Fraud and security breaches related to Swift code transactions can take various forms. These fraudulent activities can severely compromise the integrity of the financial system. Understanding these potential threats is crucial for mitigating the risk.

| Type of Fraud/Security Breach | Description |

|---|---|

| Spoofing | Imposters mimicking legitimate parties to gain unauthorized access to accounts or funds. |

| Man-in-the-Middle Attacks | Interception of communication between parties to manipulate or steal data. |

| Malware and Phishing | Use of malicious software or deceptive emails to steal credentials or sensitive information. |

| Insider Threats | Unauthorized access by employees or individuals with privileged access. |

| Typographical Errors | Incorrect or altered Swift codes leading to misdirected funds. |

Importance of Data Encryption in Swift Code Transactions

Data encryption is critical for safeguarding sensitive information during Swift code transactions. By converting data into an unreadable format, encryption protects it from unauthorized access and prevents potential breaches. Strong encryption algorithms ensure that even if intercepted, the data remains incomprehensible without the proper decryption key. This robust measure significantly reduces the risk of fraud and ensures the confidentiality of financial transactions.

Strong encryption is an absolute necessity in the digital age to maintain the confidentiality of financial information. For example, advanced encryption standards (AES) are widely used to secure Swift code transactions.

Development and Maintenance of Swift Code Systems: Swift Code Bank Of Philippine Islands

Welcome to the exciting world behind the scenes of Swift code in Philippine banking! This section dives deep into the intricate process of building and maintaining these crucial systems, highlighting the strategies employed by Philippine banks to ensure their reliability and efficiency. From development methodologies to testing procedures, we’ll uncover the technicalities that power the financial backbone of the country.The development and maintenance of Swift code systems within Philippine banks are crucial for smooth and secure international financial transactions.

These systems, while often invisible to the public, form the bedrock upon which global commerce relies. Understanding the intricacies of their development and upkeep is key to comprehending the modern financial landscape.

Development Process Overview

Philippine banks employ a variety of methodologies in developing Swift code systems, often incorporating Agile principles for adaptability and rapid response to evolving needs. This approach fosters collaboration between developers, project managers, and business analysts to ensure the system meets specific requirements efficiently. Prototyping and iterative testing phases are often integrated into the development cycle to guarantee functionality and minimize errors before full implementation.

Continuous integration and continuous delivery (CI/CD) pipelines are becoming increasingly common, streamlining the deployment process and enabling faster releases.

Maintenance Strategies

Maintaining Swift code systems is a continuous effort. Banks adopt proactive strategies to ensure the systems remain secure, efficient, and compliant with regulatory changes. Regular updates, security patches, and code reviews are essential components of this process. Documentation plays a vital role in facilitating maintenance and allowing new team members to quickly understand and contribute to the project.

Backup and recovery procedures are also paramount to minimize disruptions in case of system failures.

Testing Procedures

Thorough testing is essential for ensuring the reliability of Swift code systems. Banks utilize a multi-layered approach, encompassing unit tests to validate individual components, integration tests to verify interactions between different modules, and system tests to evaluate the entire system’s functionality. These tests often simulate real-world scenarios to identify potential issues and vulnerabilities. Security testing, including penetration testing, is critical to detect and mitigate potential security breaches.

Test automation tools significantly accelerate the testing process and increase its efficiency.

Impact of Technological Advancements

Technological advancements are constantly reshaping the landscape of Swift code systems. The rise of cloud computing, for example, is enabling banks to deploy and scale their systems more efficiently, reducing infrastructure costs and enhancing accessibility. Blockchain technology holds potential for streamlining transactions and improving security. The incorporation of artificial intelligence (AI) and machine learning (ML) could automate certain tasks, potentially enhancing operational efficiency.

These advancements necessitate continuous adaptation and investment in training for the workforce.

Programming Languages Used

The development of Swift code systems often involves a combination of programming languages, reflecting the diverse needs of various banking functions.

| Programming Language | Common Use Cases |

|---|---|

| Java | Core banking systems, back-end processing |

| C# | Application development, integration with other systems |

| Python | Data analysis, scripting, automation tasks |

| C++ | Performance-critical components, high-volume transactions |

| SQL | Database management, data manipulation |

Swift Code and Customer Experience

Swift code, a crucial part of the global financial infrastructure, plays a significant role in shaping the customer experience within Philippine banks. Its seamless integration streamlines transactions, enabling faster processing and enhanced communication, ultimately impacting how customers interact with their financial institutions.

Impact on Customer Experience

Swift code’s impact on customer experience is multifaceted. It facilitates quicker and more efficient international transactions, reducing delays and improving the overall speed of money transfers. This translates to greater customer satisfaction, as they experience less friction in their financial dealings. Improved accuracy in transactions also contributes to a more positive customer experience by minimizing errors and ensuring timely delivery of funds.

Swift Code Usage in Customer Service

Philippine banks leverage Swift code in various customer service aspects. Customer support representatives utilize Swift codes to verify transactions, trace funds in real-time, and resolve issues swiftly. This proactive approach to customer service, powered by Swift code, ensures a smoother and more reliable banking experience.

Customer-Facing Benefits

The customer-facing benefits of using Swift code are substantial. Customers experience faster and more reliable international money transfers. Swift code reduces the risk of errors, leading to more secure transactions. Enhanced transparency, provided by real-time transaction tracking through Swift code, gives customers more control and confidence in their financial dealings.

Faster Transaction Processing Examples

Swift code facilitates faster transaction processing for customers in several ways. Consider a scenario where a Filipino customer needs to send money to a family member abroad. Using Swift code, the transaction can be processed quickly, reducing the wait time considerably. Similarly, international payments for businesses are streamlined, minimizing delays in receiving or sending funds. This efficiency translates to a more responsive and customer-centric banking experience.

Comparative Customer Experience Table

| Bank | Swift Code Implementation | Customer Experience (Speed of Transactions) | Customer Experience (Accuracy of Transactions) | Customer Experience (Ease of Use) |

|---|---|---|---|---|

| Bank A | Swift code integrated into mobile banking app and website | Excellent – transactions completed within 24 hours, consistently. | Excellent – zero errors reported in recent audits. | Good – user-friendly interface, clear instructions. |

| Bank B | Swift code integrated into online banking portal | Good – transactions typically completed within 48 hours. | Very Good – minimal errors reported. | Fair – requires more navigation steps to complete transactions. |

| Bank C | Swift code integrated into branch operations | Average – transactions completed within 3-5 business days. | Good – occasional errors reported. | Poor – less convenient for customers who prefer online or mobile banking. |

Note: This table provides a hypothetical comparison. Actual experiences may vary based on individual transactions and bank policies.

Future Trends and Challenges in Swift Code Usage

The SWIFT code, a crucial component of international financial transactions, continues to evolve in the digital age. Philippine banks are deeply integrated into this global network, making the future of SWIFT code usage critical for maintaining efficient and secure financial operations. Understanding the potential trends and challenges is paramount for ensuring seamless financial interactions.The increasing reliance on automation, coupled with the emergence of new technologies, presents both exciting opportunities and potential hurdles for the SWIFT code ecosystem.

Philippine banks must adapt to these changes to remain competitive and resilient in the ever-changing financial landscape.

Potential Future Trends in Swift Code Usage

The SWIFT code system is likely to witness a surge in automation for tasks like transaction processing and validation. This will streamline operations, reduce human error, and enhance efficiency. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) will likely become more prominent. AI-powered systems can analyze large datasets of SWIFT transactions, identify patterns, and potentially predict potential fraud or errors, significantly improving the security and reliability of the system.

Furthermore, blockchain technology could potentially be integrated to enhance security and transparency.

Challenges in Maintaining Swift Code Systems

Maintaining the existing SWIFT code infrastructure and adapting to future trends presents significant challenges. The need to upgrade and maintain legacy systems, which often require specialized expertise, will remain a critical concern. Moreover, the growing complexity of financial transactions and the increasing number of parties involved in cross-border payments will place greater demands on the system’s capacity. Cybersecurity threats, a perennial concern in the digital age, will also need continuous attention.

Impact of Emerging Technologies on Swift Code

Emerging technologies like cloud computing and distributed ledger technologies (DLTs) are likely to reshape the SWIFT code landscape. Cloud-based SWIFT solutions offer scalability, flexibility, and cost-effectiveness. Distributed ledger technologies, like blockchain, have the potential to enhance the security and transparency of transactions. However, the implementation of these technologies may require significant investments in infrastructure and personnel training.

Role of Automation in the Future of Swift Code Usage

Automation is set to play a pivotal role in the future of SWIFT code usage in Philippine banking. Automated systems can handle repetitive tasks like transaction validation, reducing processing time and human error. This efficiency boost can translate to cost savings and improved customer experience. Furthermore, automated systems can adapt to changing regulations and market conditions more rapidly.

Summary of Ongoing Development of Swift Code Standards

The SWIFT code system is constantly evolving. Swift is continually updating its standards and protocols to keep pace with technological advancements and evolving regulatory requirements. These updates aim to enhance security, efficiency, and interoperability. These ongoing efforts are crucial for maintaining the reliability and global acceptance of the SWIFT code system.

Swift Code and the Philippine Economy

The Philippines, a vibrant hub of economic activity, relies heavily on seamless financial transactions. Swift codes, those seemingly cryptic alphanumeric strings, play a crucial role in facilitating these transactions, impacting everything from micro-businesses to multinational corporations. Understanding their impact is key to comprehending the country’s financial landscape.

Impact on the Overall Philippine Economy

Swift codes streamline international money transfers, significantly reducing processing time and costs. This efficiency translates to faster capital inflows, supporting investments, and enabling businesses to expand their operations both domestically and internationally. The ability to move funds quickly and securely bolsters trade relationships and encourages foreign direct investment, which are essential drivers of economic growth.

Contribution to Philippine Financial Infrastructure

Swift codes are integral to the backbone of the Philippine financial system. They provide a standardized format for identifying banks and accounts globally, eliminating ambiguity and reducing the risk of errors in cross-border transactions. This standardized approach ensures the smooth operation of international payments, a vital aspect of the Philippine economy’s integration into the global financial network.

Role in Promoting Financial Inclusion

While Swift codes primarily facilitate large-scale transactions, their underlying principles of standardization and efficiency can be adapted to promote financial inclusion. For example, the Philippines could leverage Swift code technology to create more accessible and affordable digital payment systems for underserved populations. This could bridge the gap between formal and informal financial sectors, empowering micro-entrepreneurs and small businesses to participate more fully in the economy.

Comparison with Other Countries

While the Philippines utilizes Swift codes extensively, other countries, particularly those with highly developed financial systems, might employ additional technologies or have different regulatory frameworks for managing Swift code transactions. Comparing the Philippine approach to others provides insights into areas where the Philippines can further optimize its use of Swift codes, potentially by adapting successful models from other jurisdictions.

Economic Benefits of Using Swift Code in Philippine Banking

| Economic Benefit | Detailed Explanation |

|---|---|

| Reduced Transaction Costs | Swift codes automate the routing process, reducing manual intervention and associated costs. This efficiency translates into lower transaction fees for both businesses and individuals. |

| Faster Transaction Processing | Standardized format and automated routing mechanisms of Swift codes ensure faster processing of international transactions, reducing delays and enabling quicker access to funds. |

| Enhanced Security | Swift codes employ robust security protocols, safeguarding funds and information during international transfers. This security is crucial in maintaining trust and confidence in the Philippine financial system. |

| Increased Foreign Investment | Swift codes support seamless international payments, making it easier for foreign investors to participate in the Philippine economy. This facilitates investments in various sectors, driving economic growth. |

| Improved Trade Relationships | Efficient international transactions fostered by Swift codes strengthen trade ties with other nations. This can lead to greater export opportunities and import capabilities. |

Closing Summary

In conclusion, Swift Code Bank of Philippine Islands plays a vital role in facilitating transactions and maintaining a robust financial system. Its historical context, security measures, and ongoing development demonstrate its significance. This analysis highlights the importance of Swift code in modern banking, not just within the Philippines, but globally. Understanding its impact on customer experience and the broader economy provides a complete picture of its functionality and value.

The future of Swift code in the Philippines looks promising, as technological advancements continue to shape its role in the financial landscape.

FAQ Compilation

What are the different types of Swift messages used in Philippine banking?

Different types of Swift messages, like MT103 for international transfers, MT202 for payments, and MT940 for balance inquiries, are commonly used in Philippine banking to handle various transaction types.

How does Swift code impact customer experience in Philippine banks?

Swift code facilitates faster transaction processing, which directly improves customer experience by reducing wait times and enhancing efficiency. This efficiency translates to a positive customer perception of the bank’s service.

What are some common security breaches related to Swift code?

Common security breaches include phishing attacks, malware, and unauthorized access. Strong authentication protocols, robust security systems, and employee training are essential for preventing such breaches.

What are the potential future trends in Swift code usage in Philippine banking?

Future trends might involve greater automation, integration with emerging technologies like blockchain, and increased focus on enhanced security protocols to address evolving threats.